A string of innovative and successful projects has given many British firms an advantage when bidding for contracts in international markets, according to the chief executive of one of the country’s leading programme managers.Â

Vince Clancy, the global head of Turner & Townsend, told GCR that recent schemes in the UK have provided a showcase for the the UK construction industry’s way of tackling large, multiphase projects.Â

"I’m often surprised by how much the rest of the world looks at us and what we do," he said. "I think there have been certain projects, beginning with Heathrow Terminal 5 and continuing through the Olympics and Crossrail, where on the major programme side the rest of the world are looking at us and thinking that we did it pretty well."

He said that the UK industry’s use of the "delivery partner" model and the more collaborative approach that it has pioneered between client and project teams had made it easier for British firms to win work.

On the major programme side the rest of the world are looking at us and thinking that we did it pretty well– Vince Clancy, Turner & Townsend

Clancy was speaking shortly after T&T announced its preliminary results for the year ended April 2014. These showed a 12.5% rise in net revenue and a 17% rise in after-tax profit, from $36m to $42m.Â

He said the results vindicated the firm’s strategy of diversification and globalisation, which allowed it to shift to markets where growth was still taking place amidst the financial crisis – particularly in emerging economies thriving on oil and gas and mining.

"Tactically we had to do different things and deploy resources and costs and all the other things you do when the world implodes around you, but in terms of business strategy, it worked, and that was something we began 10 years ago. As a result of that we’re now 50% bigger than we were five years ago," he said.Â

A UK boom?

Clancy said activity in the UK market had risen greatly over the past 24 months, but that it was confined to a few large urban areas, and that the industry was still some way from full recovery. "In the London market you’ve seen a big recovery in the property sector driven by residential, which has had a knock-on effect on commercial," he said. "You are also starting to see corporate clients spending again. There has then been a ripple effect going out to the regions – Manchester, Leeds, Sheffield – we’re seeing volumes increase there. Money is starting to come out of London and into those markets because London is getting too expensive."

He said the public sector bore little relation to its size before the crash, and he added that the government’s 2025 strategy was having no visible effect on the industry.

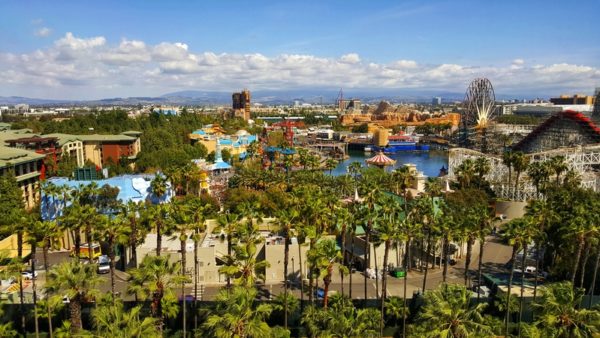

Battersea Power Station illustrates the growing influence of foreign investment from emerging economies (Wikimedia Commons)

However, he said one factor that was about to come into play in the regional market is regeneration pump-priming by Local Enterprise Partnerships, which were set up to promote economic growth throughout England and Wales, but have been largely bereft of cash to accomplish the task. Clancy said he expected the market to be buoyed up by spending on nuclear and other power schemes, Crossrail 2 and High Speed 2 and airport work.Â

However, he added that activity in the regions must be put against a number of years of low investment, and that had taken a great deal of capacity out of the construction industry. "That’s particularly true of contractors, whose order books have filled up quickly and if you’ve got a decent-sized scheme in London it’s quite hard to find a contractor to do it."Â

Future plans

Clancy said T&T was planning for the future as a fully-owned and independent global business.Â

"Who knows what might happen, but our strategy is to remain independent and centrally-controlled," he said. "We think that the consolidation that has occurred, such as Aecom’s merger with URS, has helped us because it has altered the balance of our competitors and left more space for us, and clients like us to be independent.Â

"What we will do is continue to make bolt-on acquisitions – we’ll be looking to make a couple a year."

He said the T&T saw a rise in opportunities across the world as the recovery from the crash continued, but picked out east Africa and Indonesia as two areas where T&T saw particularly exciting growth potential.Â

"We have offices in South Africa, Zimbabwe, Zambia, Kenya, Mozambique and Uganda, but we want to strengthen that. It’s a tough market at the moment but there have been massive oil and gas finds in east Africa so we see a lot of opportunity there, and we see a lot of opportunity for infrastructure in wider Africa. We are also excited about Indonesia from an energy and infrastructure point of view."

Clancy said an unexpected opportunity for consultants was offered by the increasing flows of direct investment from emerging economies.Â

"A lot of investment into the UK and Europe is coming from less mature economies," he said. "If you look at Battersea Power Station, where we’re project managers, that money is coming from Malaysia. If you look at the Shard, that money was from Qatar. We’re doing a lot of work for the Indian insurance company GIC, so we’re seeing all around the world the phenomenon of wealth coming from multinationals in developing countries."