Not quite, is the answer. But no other single country is building as much as China is.

Scanning the headlines, it can seem as if Chinese companies are building everything. For example:

- A 1,600ha new city in Modderfontein, South Africa;

- A $2.7bn railway linking Mali to the West African coast through Senegal;

- A $3.8bn, 609-km railway in Kenya between Nairobi and the port city of Mombasa;

- Airports in Nigeria.

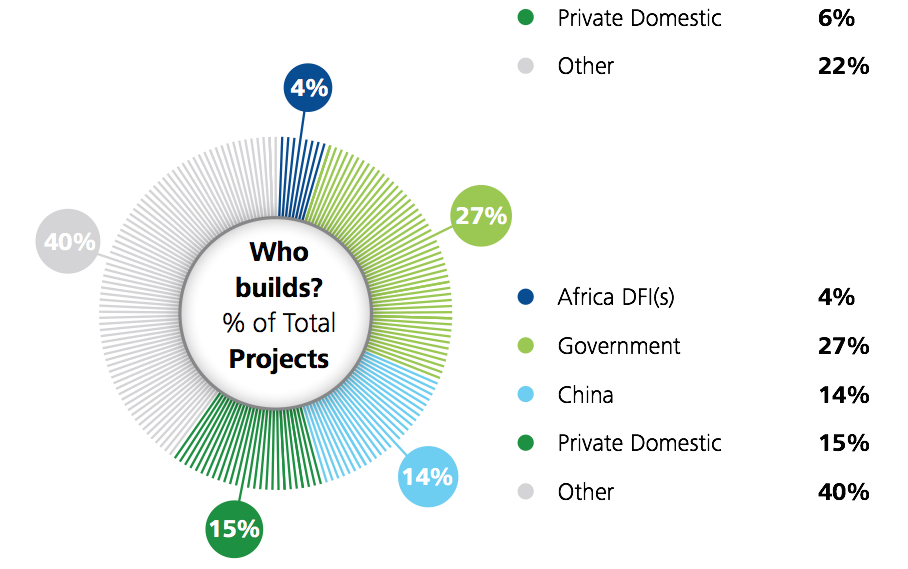

But according to the latest edition of the Deloitte African Construction Trends, released last month, China was building 14% of all major projects in Africa as of June last year.

China’s share of African construction is almost as much as the domestic private sector’s share of 15%. Governments are building 27% of projects, while Deloitte puts 40% in an unspecified “other” category.

China is building 14% of all projects in Africa, according to Deloitte (Deloitte)

At 14% of projects, China’s share is remarkable, as no other single country shows up in the ranking.

That share is also growing fast, nearly tripling in size from the year before, 2014, when Deloitte recorded China’s project share as 5% of the total.

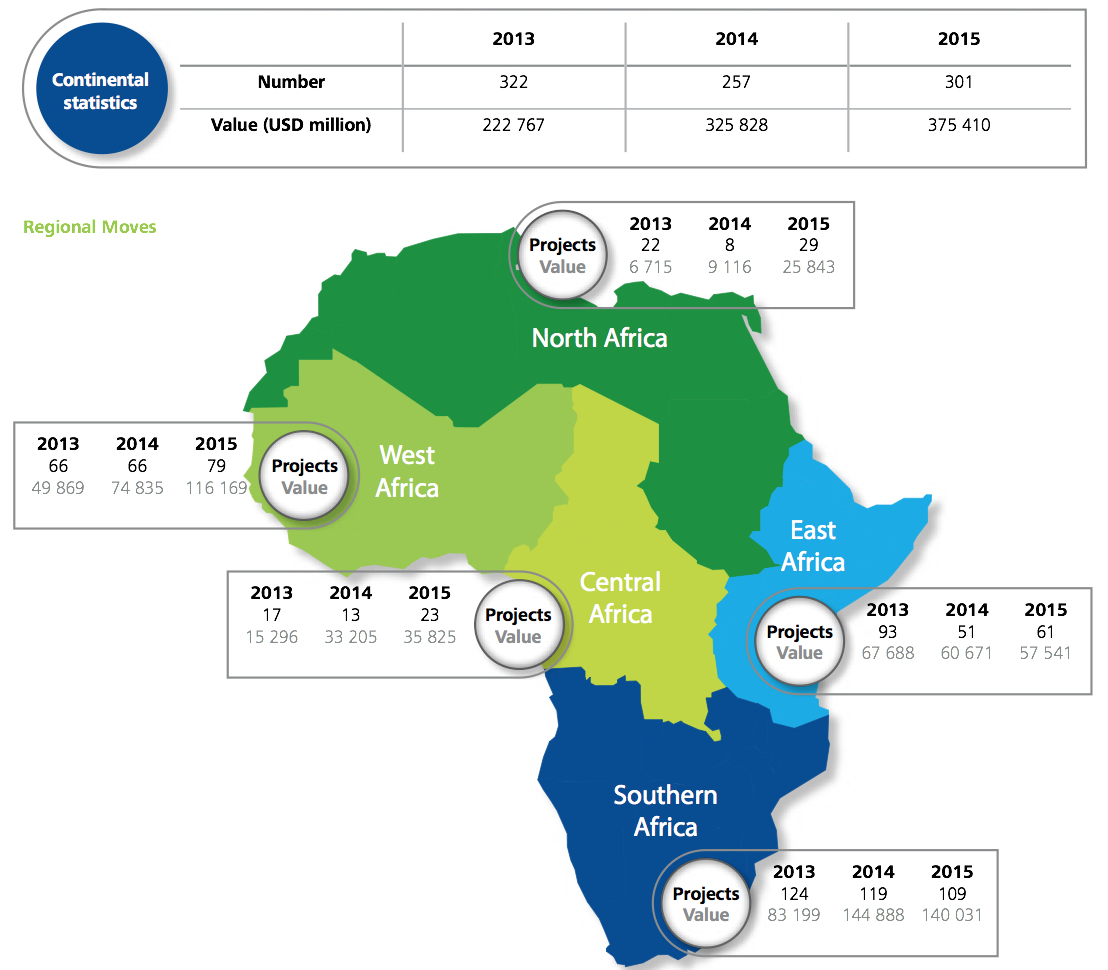

To be counted by Deloitte, projects must be valued at more than $50m and must have broken ground by 1 June 2015.

The number of projects qualifying for the study in 2015 rose 17%, from 257 in 2014 to 301. The total value of projects under construction increased 15%, climbing from $325bn to $375bn.

Continent-wide, China owns only one project, but is present in the funding of 13 projects (4%).

Looking at regions, China is most heavily involved in the poorest part, Central Africa (including Cameroon, Central African Republic, Democratic Republic of the Congo), where it is building 26% of projects and funding 4% of them.

It also beats its continental average in East Africa (Kenya, Tanzania, Djibouti, Ethiopia, Uganda), where it funds 8% of projects and is building 21% of them.

In the short term it is not clear whether China’s involvement in African construction will increase or decrease.

On one hand, it has promised major investments. In December Chinese President Xi Jinping pledged $60bn worth of assistance and loans for development in Africa at a cooperation forum in South Africa (pictured above).

On the other hand, there are signs that slowing economic growth in China, coupled with plummeting prices of minerals – which hurts the viability of big ventures dependent on mining – may be conspiring to put projects on hold.

This year has seen delays and confusion surrounding a number of planned Chinese projects, including an integrated mine, rail and port scheme in Cameroon, a new airport in Sierra Leone, and Tanzania’s new port at Bagamoyo.

China’s involvement aside, the Deloitte report shows a robust level of development work in Africa, driven by rapid urbanisation and an expanding middle class. Transport leads sectoral activity, with 37% of projects, followed by energy and power (28%).Then comes water (8%), mining (7%), oil and gas (6%), real estate (6%) and “other” (8%). A total of 37% are new, representing “good prospects for the future”, Deloitte said.

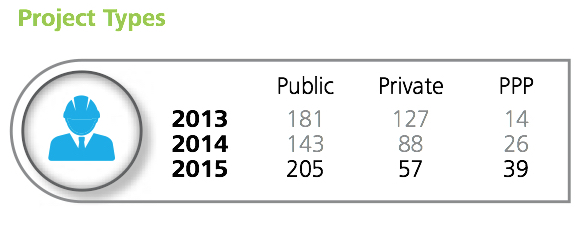

Only fourteen projects were PPPs in 2013, but last year there were 39, a rise that contrasts with the fall in privately funded projects (Deloitte)

However, investment lags in the education, manufacturing and telecommunication sectors, which collectively account for less than 2% of total projects.

Deloitte also says that social development is being neglected, and anticipated challenges in water security are not reflected in investment volumes.

International DFIs are the biggest funders, with participation in 145 of the 301 projects.

An interesting trend is the rise of public-private partnerships (PPPs) as a procurement model. Only fourteen projects were PPPs in 2013, but last year there were 39, a rise that contrasts with the fall in privately funded projects.

Top photograph: Chinese President Xi Jinping with South African President Jacob Zuma (centre) and President of Zimbabwe Robert Mugabe (right) at the China-Africa cooperation forum in South Africa on 4 December 2015 (Ihsaan Haffejee/Anadolu Agency/Getty Images)

Comments

Comments are closed.

China building Africa for sure

China has interests in the wealth of Africa (minerals mainly) and that is why is investing in these countries. I hope Africa will rise and prove to be one of the

best continents to invest in. Africans deserve clean water, electricity, good scools and universities, good health care and everything else that we take for granted.