A report by accountant PricewaterhouseCoopers (PwC) into corporate activity in the global construction and engineering sectors has found that the total value of deals in 2014 was three times higher than the previous year. Â

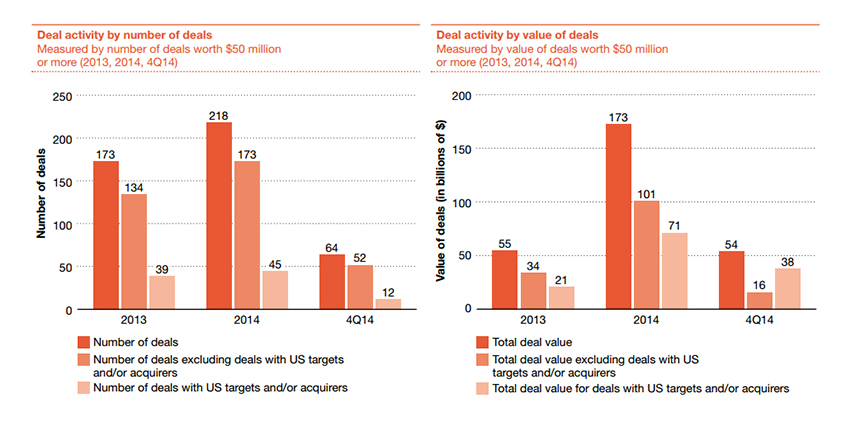

According to the Engineering Growth report, there were $173bn of transactions worth more than $50m, which is only slightly below the level achieved in 2007. The number of deals increased more than 25% and included 21 announced "megadeals", that is, those with a value of $1bn or greater, although a number of these were subsequently abandoned.

The largest deal in the construction sector is the continuing $40bn merger between cement makers Lafarge and Holcim, followed by GE’s $13.5bn acquisition of Alstom’s energy business. The largest deal to fall through was the $3.5bn merger between UK contractors Balfour Beatty and Carillion.

The Lafarge deal is still on track for completion in the first half of this year, as assets are sold to comply with competition rules.

There has been some speculation that a rise in the value of the Swiss franc would put pressure on the deal – shares are to be exchanged on a one-for-one basis despite the fact that the value of the franc relative to the euro is 14% higher than it was in April, when the deal was struck. Thomas Aebische, Holcim’s chief financial officer, told Bloomberg News this week: "We still see it as a good offer."

In terms of regions, the greatest value of deals took place in Europe, thanks in large part to Lafarge Holcim. The activity here added up to $90.1bn, of which $61bn were between local companies and $25bn were foreign companies picking up European firms, which were perceived to be undervalued by their stock exchange listings. By contrast, very few assets elsewhere in the world were bought by companies from outside the region: in the US, a strong dollar and aggressive valuations may have deterred purchasers, whereas in China, activity was subdued by concerns over the strength of the domestic market.

PwC has detected a number of trends in the raw deal data. One is the growing popularity of companies that offer a one-stop shop service. The report says: "The industry continues on a path toward full service integration, which has been a central theme of acquisition activity. Multinational clients are ‘rationalising’ vendors, choosing firms that can perform end-to-end service while firms are looking to leverage higher value added services, such as design."

It attributes domestic mergers in China as a sign that the industry is shedding excess capacity in the face of a bleak outlook for construction. It commented: "Sales of commercial and residential buildings as well as development property continue to decline in China. The apparent oversupply in the building materials sector will continue to drive consolidation in the region."Â

Another trend picked out by PwC is an increase in joint venture activity, often involving an overseas firm teaming up with a domestic counterpart so as to combine capacity and local knowledge. It also comments on the renewed interest in the acquisition of consultants specialising in sustainable development as governments toughen up carbon regulations.

Map: Countries where Swiss cement maker Holcim has a production plant (Source: Brejnev/Wikimedia Commons)