Former chief executives of bust Carillion drew angry incredulity from UK MPs yesterday as they tried to explain how the company could have lost so much money on its disastrous project in Qatar.

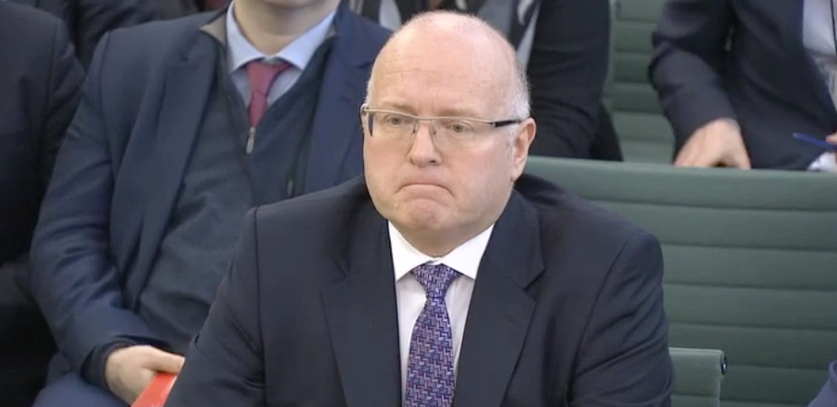

Sacked chief executive Richard Howson (pictured above) told the parliamentary inquiry he “felt like a bailiff” after going to Doha more than 60 times over six years to plead for payment, to no avail.

He complained of a chaotic client who changed architects three times, issued thousands of design changes, and ended up owing Carillion around £200m – one of the main causes of its liquidation on 15 January.

But he got no sympathy from MPs, who demanded to know why Carillion would enter such a risky project in the first place, and why the company did not walk away or declare the problem sooner.

Keith Cochrane, who replaced Howson as interim chief executive when the latter was fired in July 2017, appeared to blame Howson for not resolving the Qatar account, while admitting he failed to do so himself.

Cochrane also said Howson led the Carillion board to believe the Qataris would settle their gargantuan bill in April that year.

MPs on the joint committee inquiry into Carillion were only scathing after hearing evidence from Howson, Cochrane and other top executives, including former chairman Philip Green.

Commenting on the overall collapse, the committee co-chairs called them all “delusional”.

“This morning a series of delusional characters maintained that everything was hunky dory until it all went suddenly and unforeseeably wrong,” said a statement from co-chairs Frank Field MP and Rachel Reeves MP.

“We heard variously that this was the fault of the Bank of England, the foreign exchange markets, advisers, Brexit, the snap election, investors, suppliers, the construction industry, the business culture of the Middle East and professional designers of concrete beams. Everything we have seen points the fingers in another direction – to the people who built a giant company on sand in a desperate dash for cash.”

“I felt like a bailiff”

In a confrontational and disjointed interrogation, Howson tried to explain how hard it was to execute the project, and to get paid in the Gulf generally and Qatar in particular, where in 2011 Carillion won a £493m ($650m) contract with a local firm on part of the $5.5bn Msheireb Downtown redevelopment in Doha.

Howson, who became chief executive in December 2009, said Carillion decided to go into Qatar that year to compensate for the shrinking of the UK market in the wake of the financial crisis. The plan was to double the size of both its Middle Eastern and Canadian construction operations, with each endeavour turning out badly.

Msheireb was the only job Carillion ever won in Qatar – “thankfully”, said Howson – and it was meant to have taken just two and a half years, but is now stretching into its seventh year.

“The customers changed the architect three times, they issued forty thousand new drawings within eight months,” he said.

“It’s been a very difficult contract.”

“I personally visited pretty much every month of the year, certainly 10 times a year, for the last six years – I felt like a bailiff – just to try and collect the cash.”

Accused of being reckless in getting involved in it, Howson defended himself, saying Carillion had a small team searching for the right clients for the two years prior, and Msheireb had been identified as suitable.

But he painted a picture of a risky environment where contractors must effectively plead for payment.

“I’ve lived with this personally,” he said. “The only way to ensure that you are paid reasonably in the Gulf is through personal relationships with your customers. There’s no point writing nasty letters, no point appointing lawyers, it’s about being there and the give and take of delivering, and receiving cash.”

He said Carillion had better traction when Msheireb changed its CEO, but that “stopped at the end of 2016”.

Trapped in Qatar

Howson said that at the start of 2017, he was banking on bringing “six or eight” troublesome contracts, including Msheireb, to a close by the end of the year, which would have released much needed cash.

Keith Cochrane, who replaced Howson as interim chief executive in July 2017, gives evidence to MPs on 6 February 2018 (From televised proceedings)

In Qatar he said Carillion was trapped by onerous performance bonds, and would have had to pay another contractor to finish the job if it withdrew. “Working in the Middle East is very different to anywhere else,” he said.

MPs, however, struggled to understand how Carillion could have entered such a risky contract in the first place.

The following exchange between Howson and co-chair Frank Field was typical of the session.

“You were saying you couldn’t do anything about the Qatar non-payments because you had signed penalty clauses in which, if they operated, would cripple you,” Field said. “Why did you actually sign those contracts?”

“On the Qatar contract … because of the size of the contract, they have performance bonds … so if you wilfully abandon – they would say – the contract, walk away, they would pull the performance bonds,” Howson replied.

“Even though they weren’t paying?”

“Even though they weren’t paying.”

“And you signed up to that?”

“And we didn’t have suspension rights…”

“And you signed up to that?”

“We did sign up to that in 2011.”

A fair question?

When he was questioned, Keith Cochrane sparked ire from the committee co-chair for an apparently complacent response to Carillion’s handling of Msheireb.

Cochrane, a non-executive director who stepped into Howson’s role in July 2017 after Carillion revealed an £845m black hole in its finances, appeared to blame Howson for not getting a result in Qatar and for raising the board’s hopes for a resolution in April that year.

But he ended up admitting he hadn’t been able to settle the issue either.

“This is a job that doubled in size, [had] two and a half thousand design variations to it, and essentially we weren’t paid for 18 months prior to the business failing,” he said. “Should we have done something differently about that? I think that’s a fair question to ask.”

That prompted an incredulous response from co-chair Rachel Reeves, who shot back: “It’s not just a fair question, Mr. Cochrane, if you weren’t paid for 18 months … why did you carry on doing the work? Should you not have put an impairment in, should you have not accounted for this much sooner?”

Cochrane replied: “One of the roles of the previous chief executive was to have direct engagement with a number of key customers, and I do recall an April [2017] board meeting …Â in Manchester when Richard Howson came back and said they’ve agreed they’re going to pay all their bills. And that then led … so there was this expectation of getting paid. Having said that, six weeks later the world had changed for a variety of reasons, and they won’t pay.”

Asked again why Carillion had not publicly accounted for the failing project, Cochrane said it was a “judgement call” at the time.

“All I can say is that I looked at that contract and certainly in my tenure as chief executive I sought to achieve a settlement as well, and we had the ups and downs of those negotiations, ultimately failing.”

Who knew what, and when?

In March 2017 Carillion issued optimistic results for the previous year, stating that revenues were up by 14%, that it enjoyed “good cash flow” and a “high-quality order book”.

But questioned by Rachel Reeves, Richard Howson admitted that when Carillion issued those results, it was owed up to £190m on the Qatar job.

At that time, he said, the job was due to finish in May. But during March and April completion was moved to September because Carillion still hadn’t been paid. There were 6,000 people on site then, but it needed 12,000 people to finish, he said.

Projected completion was then pushed back further, to December 2017. “My understanding now is it finishes in December this year,” he said.

Howson then said he was retained, after he was removed as chief executive, to reach a settlement on the Msheireb contract.

Former chairman Philip Green said the board began to blame Richard Howson for not cutting Carillion’s overall debt in the spring and early summer of 2017.

Asked why the board did not remove Howson sooner, Green said Howson was removed when the board became aware of the problem.

“We did remove Mr. Howson as chief executive because, frankly, in the period of May to June we had begun to lose confidence because the debt wasn’t coming down and the operational difficulties were increasing,” Green said. “We hadn’t been able to successfully do the rights issue. As soon as the board formed a view, we did take action.”

Other witnesses from Carillion to the inquiry of the joint Business, Energy and Industrial Strategy – Work and Pensions committee included Zafar Khan, chief financial officer between January 2017 and 11 September 2017, Emma Mercer, CFO from 11 September 2017, Richard Adam, finance director from April 2007 to December 2016, and Alison Horner, chair of the remuneration committee from December 2013 to January 2018.

Three other investigations into Carillion have been launched.

Top image: Formed Carillion chief executive Richard Howson giving evidence to a joint committee of UK MPs on 6 February 2018 (From televised proceedings)

Further Reading:

Comments

Comments are closed.

As Carillion found out to its cost, there are good reasons why international tier 1 contractors won’t tender for work in Qatar or the UAE – significantly local law prohibits suspension of performance as a response to non-payment.

Things work differently in the gulf. I know of a drawing revised over 20 times!

Carillon was probably excited to get the offer but in reality, they walked blind into an unknown terrain. That still doesn’t explain why they haven’t been paid. it would be interesting to know what the contract terms were.

Nevertheless, many companies are able to manoeuvre their way with clients to stay in business here in the gulf.

Lies.

Carillion had more than 1 contract in Qatar.

They had a framework contract for Ashghal working on Dukhan Highway and Salwa Road.

How are these executives getting away with barefaced lies to the committee and still getting severance pay.

I think they are making excuses, hiding behind the facts that they had no idea how to handle the situation so they let it go on brushing the problems under the carpet.

There are two sides to every story. Clients may have been late in paying, but did the Contractor administrate the contract to secure payment? Collapses of this nature were inevitable, judging from the ever declining attention to Contract Administration over the past decade. It is time that industry stakeholders paid better attention to that important fourth element – Administration of the Contract, without being obsessed only on Time, Price and Quality.

I have worked in the gulf as a claims consultant for 12 years or more and have ben in the position with a number of companies in identical positions being owed vast sums of money, withheld for no genuine reason by the Arab Client. Clients who ignore the contractual agreement to suit their interpretation and continually promise to make payment to the contractor leading the contractor into further debt. The client issues a myriad of instructions and changes without accepting that they will be required to pay for the additional work. In the meantime the contractor is obliged to carry out the works. If a contractor had the strength to withdraw from the onerous contract conditions, it is quite possible that the passports of their key staff would be confiscated until such time as the project was completed.

Unless you have worked in these countries, you cannot appreciate the illegal pressures that are imposed by the client through his tribal/family contacts, who will impose the letter of the contract upon the contractor, but ignore the contract when it suits them. It is my opinion that many companies operating within the Gulf are falling foul of this client attitude and more will fail in the future.

It is very true story! Qatar is one of the most contractor unfriendly country in the world.