The Chinese government is said to be considering the merger of China Railway Group and the China Railway Construction Corporation, a deal that would create a company with a combined turnover of $185bn.

The plan, of which the companies themselves deny knowledge, was mentioned to magazine China Economic Weekly by Wang Mengshu, the deputy chief engineer at China Railway Tunnel Group and also a National People’s Congress deputy, during an interview.Â

He said the government was interested in merging the companies, both of which are state-owned, for domestic reasons. The government’s aim is to curb corruption and give China Railway, the national railway operator, a single infrastructure partner to deal with.

China Railway Group is the third biggest construction company in the world, with a turnover of $89bn, according to Engineering News-Record‘s 2014 rankings, and the China Railway Construction Corporation is the second largest, with $96bn. Â

A merger would create the 14th biggest company in the world, according in the Fortune 500, larger than Warren Buffett’s Berkshire Hathaway investment company but below South Korea’s Samsung Electronics.

We think a merger might be difficult to execute given the two companies’ complicated business structures– Robin Xu, an analyst with USB

Yesterday, the two companies filed statements with the Shanghai Stock Exchange saying they had received no information about a merger from the government authorities and that they were not planning such a deal. Â

At the end of last year, the world’s two largest train makers, the China North Car and China South Car corporations, agreed a merger. The new company, to be known as CRRC, will make 80% of the rolling stock on China’s railways. Â

Some financial commentators were sceptical about whether the government would really follow suit with its infrastructure companies. Phyllis Wang, a senior vice president of Taishin International Bank, issued a note saying the train maker merger was intended to put an end to competition between the two for overseas markets, whereas the infrastructure companies do not compete to the same degree.  Â

Robin Xu, an analyst with USB, issued a note that said: “We think a merger might be difficult to execute given the two companies’ complicated business structures. Other than the infrastructure business (including construction and design), both companies are involved in machinery, property development and other non-core businesses. Even within the infrastructure business, both companies have many subsidiaries focusing on different regions.” Â

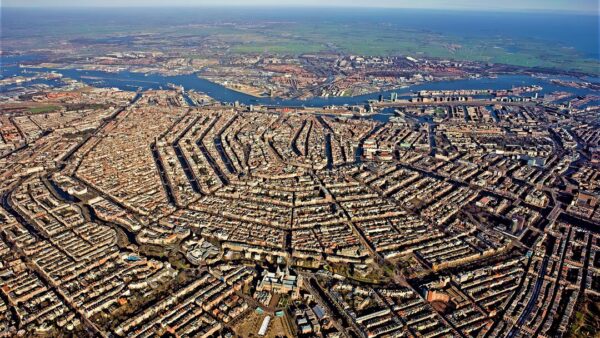

Photograph: Caption: Such a merger would create a single infrastructure company and a single train maker for China’s domestic market (KimonBerlin/Wikimedia Commons)