One of China’s biggest global contractors says it will no longer blindly go where others fear to tread.

26 April 2013

This week, Chinese heavyweight Sinohydro won its first project in Bosnia.

It’s going to build a 35-megawatt hydropower plant on the Neretva river at a cost of approximately $80m.

For the 14th biggest global contractor in the world (according to ENR), with 2011 revenues standing at approximately $18bn, this may not seem like that big a deal.

But it is evidence that its new strategy of expanding out of risk-laden places like Africa is starting to take effect.

Wang Zhiping, Sinohydro’s board secretary, says the company is shifting away from what has been the dominant pattern of Chinese construction firms abroad: pursuing work where others fear to tread, in developing countries, backed by state loans.

“We’d rather drool than shed tears,” Mr Wang pithily told the Financial Times in an interview on 10 April.

He said Sinohydro decided to take a more cautious tack about five years ago, admitting, “our risk prevention awareness was poor at that time”.

The need was amplified by its experience in Libya, where Sinohydro was building a $2bn residential complex when the country descended into civil war.

The conflict cost Sinohydro $1.2bn in suspended contracts and $32m in writedowns, he estimated.

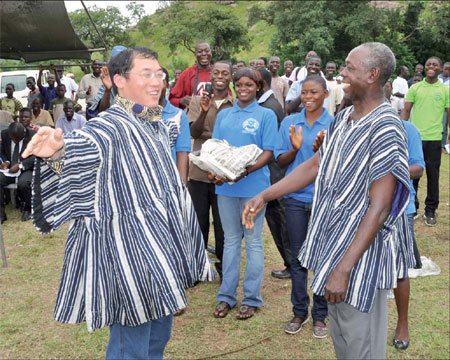

Sinohydro employee Liu Xiuping (Credit: Sinohydro)

Sinohydro has also been caught up in other conflicts with workers either killed or kidnapped in South Sudan and Afghanistan. And the current conflict in Mali threatens to jeopardise one of its hydropower projects.

“If the risks are too high, we just won’t go there [now],” Mr Wang told the FT. “Our greatest concern is the instability caused by political risk in overseas markets, including armed conflict.”

The group is slightly more risk-averse than other state-owned construction companies.

Even though 65% of Sinohydro’s equity is held by its state-owned parent corporation, it is listed on the Shanghai stock exchange, and must perform like a proper listed company.

But a wider trend may be evident as well. The FT notes that China’s commerce ministry recently issued new regulations for overseas contracts that include tougher environmental standards and fresh anti-corruption rules, which the FT called a “tacit admission of the challenges that have accompanied China’s rapidly expanding commercial presence overseas”.

Sinohydro says it now wants to move beyond emerging markets. “The European and American markets are our next focus for international business,” Mr Wang said. “We want to be a world-class contracting company.”

That’s why the Bosnia contract this week may be a big deal after all.

Shourav Lahiri, a lawyer at Pinsent Masons who advises on Chinese infrastructure deals, told the FT that the remarkable fanning out of Chinese firms to the developing world was not unique in history.

“Just as British and American companies built the world’s infrastructure 30 and 40 years ago, followed by the emergence of Japanese and Korean construction companies, Chinese companies are following the same trend,” he said.

Read the FT interview here.