Contractors working on projects in Saudi Arabia are being asked to cut their costs by 20% as the Kingdom struggles to deal with a ballooning budget deficit caused by the low oil price, an expert on the region has said.

Thomas Wilson, the managing partner in the Dubai office of global law firm Squire Patton Boggs, told GCR: “Saudi rules allow the government to increase the scope of contracts by 10% or decrease it by 20%. So clients are saying to contractors, you have to cut by 20%.

“Problems arise when you’re building something like a railway. You can’t make it 20% shorter so the contractors are saying which 20% do you want me to cut? And clients are responding, well we’re paying you 20% less, so you figure it out.”

You can’t make a railway 20% shorter so the contractors are saying which 20% do you want me to cut? Clients are responding, well we’re paying you 20% less, so you figure it out– Thomas Wilson, Squire Patton Boggs

Wilson was speaking at the sidelines of the Chartered Institute of Building’s Inspiring Construction conference, held in London yesterday, at which he gave a presentation on the effect of the oil price slump on the Gulf Co-operation Council states.

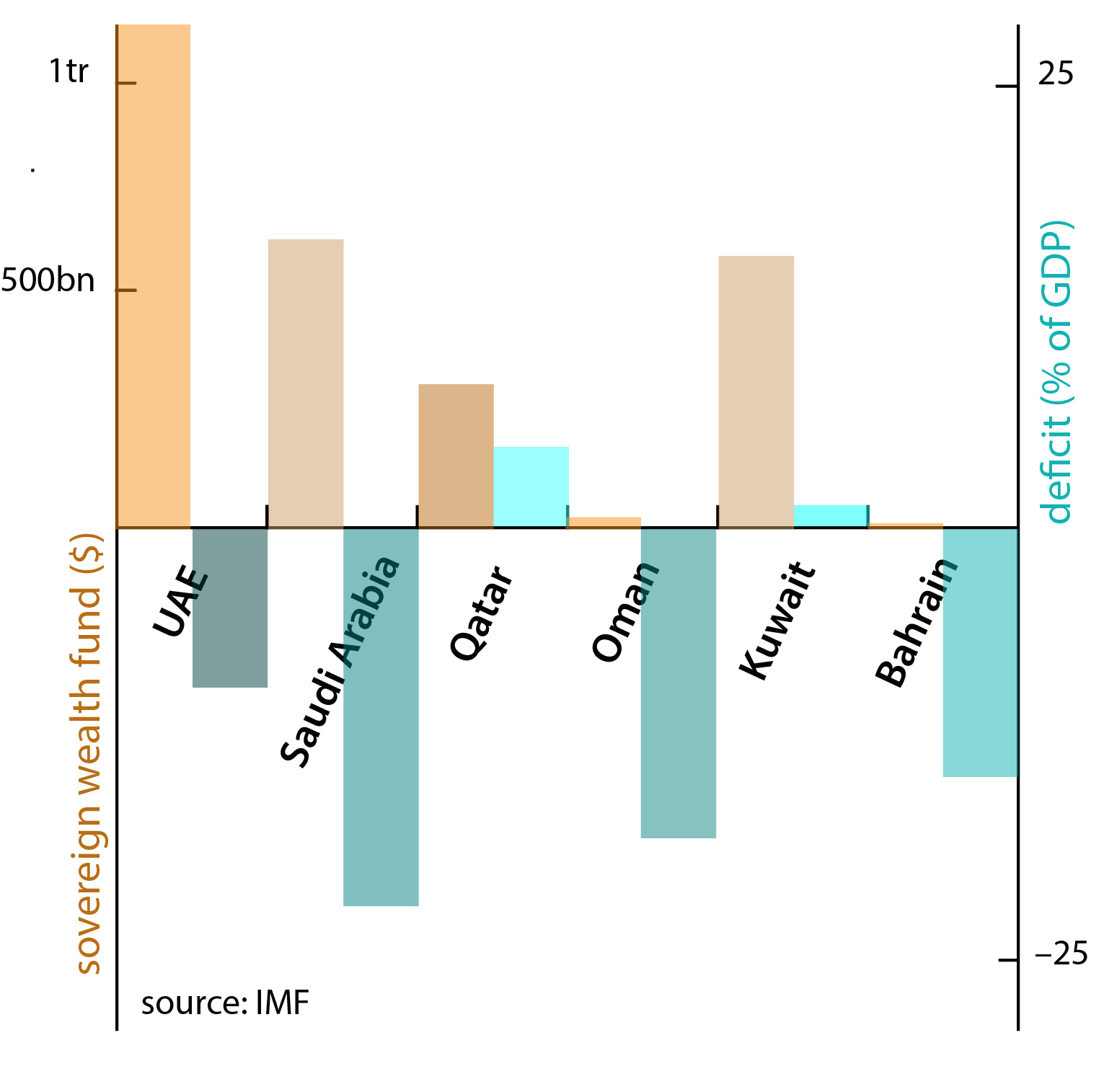

Of the six member states – Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman and Bahrain – Wilson said the Saudis were facing the most difficult future.

Saudi Arabia’s budget deficit has increased from 3.4% last year to 21.6% this year, according to the IMF. The shortfall has been caused by the fall in oil prices from $110 a barrel in July last year to around $47 a barrel.

At the same time, Saudi Arabia’s ambitious economic investment programme has meant that the price-per-barrel required to balance its budget has risen from around $67 between 2008 and 2012 to $106 today.

What is particularly troubling for economic planners and construction firms alike is that this low price is expected to persist for the foreseeable future – the IMF has forecast that prices will be at $66 by 2020.

As a result, some analysts have predicted that the Kingdom could exhaust its $670bn sovereign wealth fund in five to eight years.

The financial squeeze – some Gulf countries are under more pressure than others (GCR) Source: IMF

Meanwhile, the rapid growth of the Saudi population commits the government to continuing investment. Wilson said the Saudi government understood that it had to continue providing jobs and a certain standard of living to safeguard political stability.

“At the same time there are efforts afoot to slow projects and slow spending, and to stretch their dollars by asking contractors to shoulder financial costs, for example by delaying payment,” he said.

But the change in the financial climate could also bring opportunities, Wilson said.

All GCC governments are showing an interest in public-private partnerships (PPPs), and those contractors that can provide their own finance will be at an advantage. This will favour Chinese firms and those accustomed to working in PPP consortiums.

He said: “If you can bring financing you certainly increase your opportunities, and a number of Chinese and Turkish contractors have been able to win contracts on the back of bringing their own construction-phase financing, allowing governments to delay payment until projects are operating.”

Photograph: The Kingdom Centre tower in Riyadh, Saudi Arabia’s capital and largest city (Sauditourism.sa)

Comments

Comments are closed.

The article was really informative providing an insight to current oil price scenario