The UK construction industry has recorded its first negative growth for 11 months as housebuilding slows and clients delay capital investments until Brexit is resolved.

The IHS Markit/CIPS Purchasing Managers’ Index (PMI) was at 49.5 in February, down from 50.6 in January. A figure of less than 50 indicates that more respondents expect less activity than in the previous period.

This is the first time the index has been in negative territory since the icy spell of March 2018 (pictured), and marks the lowest point for the industry since September 2017.

Duncan Brock, group director at CIPS, said: “In short, the foundations of the construction sector are crumbling under the weight of Brexit and businesses are switching to survival mode until the way forward is cleared.”

The survey found that residential work was the best performing area but the rate of expansion was modest and not enough to offset declines in the commercial and civil engineering categories.

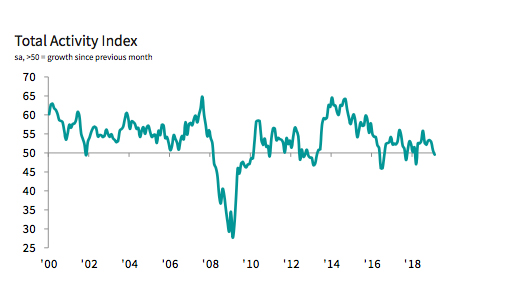

The IHS Markit/CIPS track of UK construction since the crash

Tim Moore, economics associate director at IHS Markit, said the key factor in the decline was a loss of confidence in the commercial sector, which is more exposed to Brexit risk than residential. He commented: “Risk aversion in the commercial subcategory has exerted a downward influence on workloads throughout the year so far. This reflects softer business spending on fixed assets such as industrial units, offices and retail space.

“The fall in commercial work therefore hints at a further slide in domestic business investment during the first quarter, continuing the declines seen in 2018.”

Moore also added that residential may not be able to underpin the industry for long, as the UK’s fragile housing market had “begun to act as a brake on residential work” leaving the sector “increasingly reliant on large-scale infrastructure projects for growth over the year ahead”.

Top image: The beast arrives in London: The last time things were this bad was March 2018 (Martin Tooth)

Further reading:

Comments

Comments are closed.

I’m always curious as to how Brexit specifically is at fault for this decline. Confidence is attributed to a lot of issues but moreover I find them to be globally related (oil, war, gold prices etc.) which shakes the market. Brexit is more of an enigma. Honda are a good example of this, BBC2 radio aired a mid day programme discussing workers who voted for Brexit should be made redundant first whilst Remainers go last, it was like a McCarthyism witch hunt. That evening the CEO of Honda declared Brexit was not a factor in their decision to close, how embarrassing is that. And how quickly was everyone to jump in. We should be questioning whether we are really out of the austerity programme more than anything, The chancellor eased measures but to some extent one feels that he may be trying to defibrillate the market into life. I don’t like panic or people who create it. I would like to see the specific correlation between the headline claim and the association with Brexit to positively diagnose the cause. Do we all live in a bubble ? is Brexit not a democratic decision? Are there other reasons we should all consider such as black markets, cheap labour, declining manufacturing industries. Even before Brexit I think we would all agree that we have had problems with supply chains such as long lead ins on bricks for example. It just seems like such an easy target these days and I’m worried we may be coming complacent about deeper issues. Is it just me or is Parliament causing this problem, end the uncertainty and let the captains of industry do their job. MPs should concentrate on bigger issues such as education, encouraging the next generation of skilled tradesmen, promoting public sector growth, promote the UK manufacturing industry and facilitating the change rather than frustrating their clients and pretending to know better than captains of industry. The market will bounce back, it always does, sustainability is the key word but how can you do this when you don’t have control over global markets?.