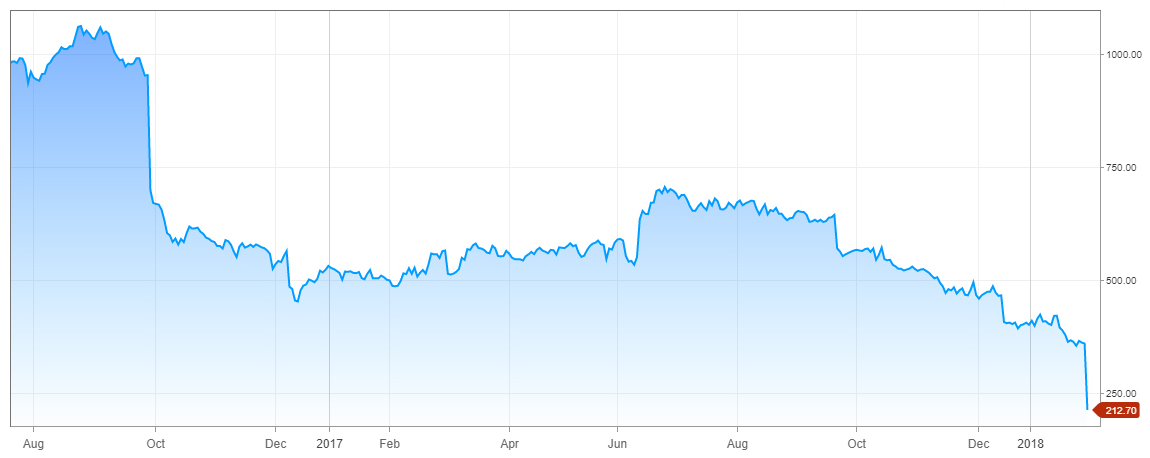

Shares in UK outsourcing group Capita fell 38% today after the group lowered its profit forecast for 2018 by about £120m ($170m) – a fall of 30%. The shares are now trading at 213p, about a fifth of their level last September.

Its new chief executive said Capita is “too complex” and “is driven by a short-term focus and lacks operational discipline”.

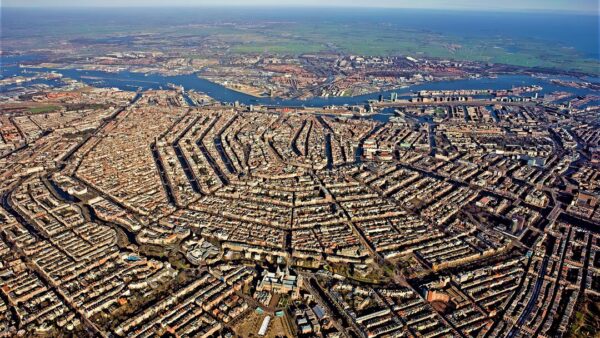

The company, which has a turnover of £4.9bn, makes half its income from running public services, including pension schemes for teachers and Royal Mail workers and London’s Congestion Charge.

The company’s share performance since August

Its Real Estate and Infrastructure division carries out a wide range of activities, from design to facilities management, and it runs the Constructionline vetting service for those wishing to employ a contractor.

Fears over the financial health of Capita have been heightened by the fall of Carillion. However, its financial difficulties are not as severe. Following today’s price slump the company has a market capitalisation of about £1.4bn and net debts of £1.15bn. Its pension deficit stands at £381m.

It has already announced plans for the £700m rights issue to reduce its debt pile and will suspend dividend payments.

Jonathan Lewis, who took over the chief executive role in December, accompanied today’s profit warning with a root-and-branch critique of the company’s performance.

Capita runs the Constructionline service that aims to weed out cowboy builders

He said: “Today, Capita is too complex, it is driven by a short-term focus and lacks operational discipline and financial flexibility.” He added that the company was “too widely spread”, had under-invested and there had been “too much emphasis on acquisitions to drive growth”.

The company will now enter a lengthy restructuring programme, which will include the disposal of non-core assets and the raising of equity from shareholders. The aim is to “increase the focus of our resources on a smaller number of markets with the best prospects”. He also announced the creation of the post of “transformation officer” to drive the changes. Â

Top image courtesy of Capita

Further Reading:

Comments

Comments are closed.

Finally, a Chief Executive who may influence positive change in Capita. As an ex Capita employee and senior manager within the property and infrastructure business, I can say from first hand experience that the business operational model and core strategy undermines the positive aspects of the business. With an unyielding emphasis on making the forecast numbers per month, despite the fact that property and construction isn’t a linear, ‘same number’ volumetric per month. This brought huge pressure on managers like myself to trying to meet Board level BP expectations. The almost mercenary approach to making numbers was driven by a company strategy which focussed on company acquisition as growth, rather than through natural client relationship. The endless search for the right person to lead this strategy saw during my tenure of 8 years 9 Operational Directors!. The absurdity of acquiring businesses undertaking the same service as we did based in same geographic location, operating in the same sectors and all vying for the same client base and yet all expected to meet unrealistic BP targets accordingly, seemed beyond comprehension to the accountants who make up most of the Senior Board level membership and level 1 management hierarchy. Those of us of whom do understand property and construction did not have a voice or an opinion that matters sadly. I hope this is a start of positive mind-set change for a company that has some excellent, very capable individuals at lower levels in the hierarchy.

Yes agree totally with the last writer, having worked for Capita managing a very large Housing Redevelopment Design PM project; good people but in property a serious disconnect between Property Professionals & the Accountants metrics. The one size fits all mentality in relation to bidding & operations for different sectors does not work for these large organisations.