A European-led consortium involving Spain’s Ferrovial and French investor Meridiam has been picked to finance and build a revamped 35-km section of busy highway in the state of Virginia, and will be able to collect tolls on it for 50 years if the deal reaches financial close.

Virginia Governor Terry McAuliffe hailed his own tough negotiation of the public-private partnership (P3, or PPP), saying the group, called Express Mobility Partners, would pay $500m up front for the concession on the Interstate 66 (I-66), and a further $1.15bn for improvements during the concession period.

The announcement follows a string of high-profile failures in toll-road P3 schemes where concessionaires went bankrupt after predicted toll revenues failed to materialise, leaving investors and taxpayers out of pocket.

Governor McAuliffe said Virginians would pay nothing up front for the new section of road, called “Outside the Beltway”, which passes the city of Fairfax while ferrying commuters in and out of nearby Washington DC. He claimed further that reforms to his state’s P3 framework protected taxpayers from disadvantageous deals seen in the past.

This project will transform travel in the I-66 corridor and pave the way for additional multimodal options that will reduce congestion and commute times– Governor McAuliffe

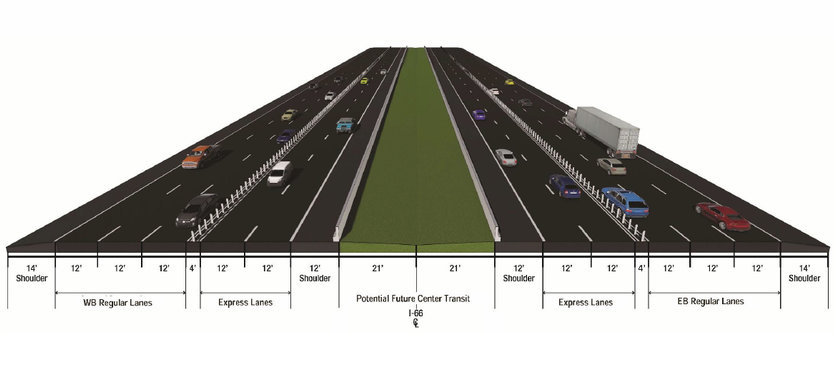

The project would see Ferrovial widen the I-66 to five lanes in each direction, including two “dynamically” tolled express lanes and three regular lanes, with space in the median for future transit.

If a car has three or more people in it, they can use the express lanes for free, while other drivers would have to use a variable toll to use the express lanes.

Ferrovial said the construction cost would be approximately $3.3bn (€3bn). Its subsidiary, Cintra, and Meridiam will be responsible for project development. Ferrovial Agroman, with local construction company Allan Myers VA, Inc. will handle design and construction.

“This project will transform travel in the I-66 corridor and pave the way for additional multimodal options that will reduce congestion and commute times,” said Governor McAuliffe, announcing the choice of Express Mobility Partners on 3 November.

He said it was the first major procurement process to follow his reforms to the state’s P3 process to increase competition, accountability and transparency in P3 projects after “several high profile problems”.

McAuliffe said that before he took office in 2014 it had been estimated that the project would need up to $1bn of state funds to lure a private sector partner. But after reforms to the process and his threat that the state was willing to build the new lanes itself, the state received “two bids that were far more financially competitive than the original analysis”, a statement from the governor’s office said.

“P3s are a powerful tool for procuring new projects, but they only work if taxpayers’ interests are protected,” McAuliffe said. “The reforms we have established strengthened Virginia’s negotiating position for this project and helped us secure the right project for the right price for taxpayers.”

The new tolled section of the I-66 will have five lanes in each direction, including two “dynamically” tolled express lanes which cars can use without charge if they have three or more people in them (VDOT)

Meanwhile, other P3 road schemes built on projected toll revenues have failed in the US and Australia, raising questions about the business model.

In March a P3 concession company set up by Cintra and local contractor Zachry Construction went bankrupt after accumulating more than $1.6bn of debts when toll revenues on a new section of State Highway 130 in east Texas failed to live up to predictions after it opened in 2012.

That left the US federal government out of pocket to the tune of $430m, a sum it had leant the scheme when the deal closed in 2006.

When it filed for Chapter 11 bankruptcy protection the P3 concession company, SH 130, blamed the 2008 financial crash for lower-than-predicted toll revenues, but an investigation by newspaper The San Antonia Express-News revealed that the State of Texas had previously declined to build the toll road itself because its traffic projections indicated that revenue would cover only half the cost of construction.

Other US cases of P3 toll schemes going bust while owing the federal government money include the “Pocahontas Parkway” scheme in Virginia, and the South Bay Expressway in San Diego, California.

There have been problems in Australia, as well. In June of this year, investors in Brisbane’s A$2bn Clem7 tunnel, which went into receivership in 2011, won A$121m after they brought a class action lawsuit against traffic forecaster Aecom Australia and owner-operator RiverCity Motorway.

In September 2015 it was reported that Aecom Australia had paid A$280m to settle a lawsuit over the Clem7 tunnel.

In another case, last year traffic forecaster Arup Pty Ltd settled a class action brought by IMF Bentham in the Australian Federal Court over its traffic predictions for Brisbane’s Airport Link toll road. Background to that scheme can be found here.

Investors in Virginia’s I-66 toll scheme, meanwhile, will be hoping the numbers stack up.

Virginia’s Department of Transportation is expected to sign a comprehensive agreement with the consortium in early December, with financial close expected in mid-2017.

Project construction will start in 2017 and the express lanes will open to traffic in mid-2022.

I-66 Express Mobility Partners includes equity members Cintra and Meridiam; lead contractors Ferrovial Agroman US and Allan Myers VA, Inc.; and lead engineers Janssen & Spaans Engineering, Inc., the Louis Berger Group, Inc. and American Structurepoint, Inc.

Top image: Rush hour traffic on I-66 westbound in Fairfax County, Virginia (MPD01605/Wikimedia Commons)

Further Reading: