A large Mexican housebuilder has settled charges that it reported sales of ten of thousands of homes it never even built, overstating its revenues by $3.3bn.

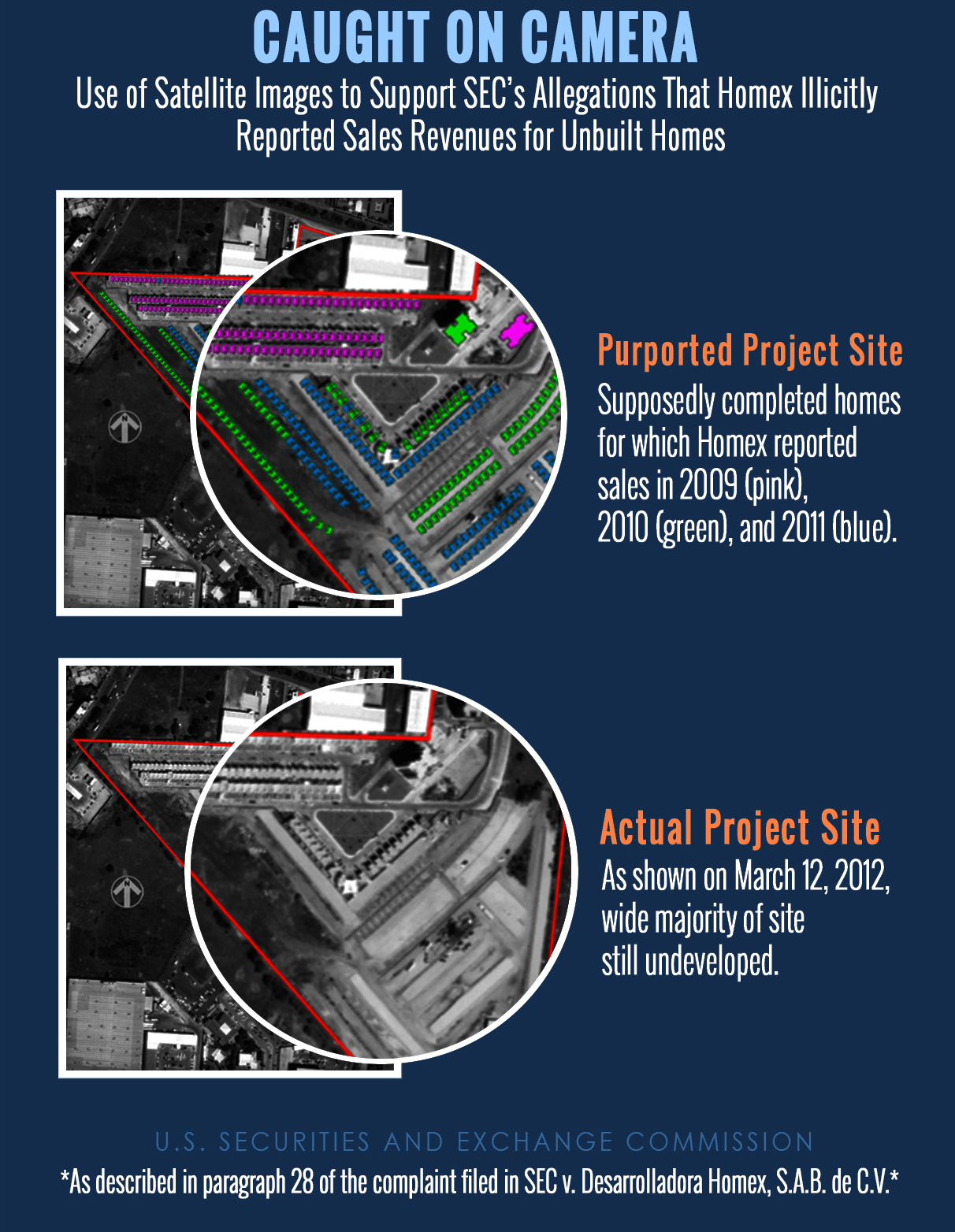

Desarrolladora Homex agreed to a settlement after the US Securities and Exchange Commission (SEC) used satellite photography to prove the company never started many of the developments it claimed to have finished.

At one site in the state of Guanajuato, Homex reported that every planned home had been built and sold by the end of 2011. But satellite images taken in March 2012 showed that it was still largely undeveloped.

According to the SEC, Homex inflated the number of homes sold by 317% and overstated its revenue by 355%, or $3.3bn.

Tens of thousands of purportedly built-and-sold homes were, in fact, nothing but bare soil– Melissa Hodgman, US Securities and Exchange Commission

At their height in 2008, Homex shares were selling for more than 1,200 pesos, but last week they were worth less than one peso.

Under the settlement, Homex agreed that for a period of five years it will not participate in the US stock market and will not publish any financial or business information in English on its website or any other electronic information distribution service.

The deal must be approved by a US court, and Homex did not admit culpability.

The company, one of the largest housebuilders in Mexico, filed for bankruptcy protection in April 2014 and emerged in October 2015 with new equity ownership.

The company’s former chief executive and chief finance officer have been placed on unpaid leave since May 2016 and, according to the SEC, Homex has undertaken “significant remedial efforts” and cooperated with its investigation.

Courtesy of the US Securities and Exchange Commission

Stephanie Avakian, acting director of the SEC’s Enforcement Division, said in a press statement: “The settlement takes into account that the fraud occurred entirely under the watch of prior ownership and management, the company’s new leaders provided critical information regarding the full scope of the fraudulent conduct, and the company continues to significantly cooperate with our ongoing investigation.”

Melissa Hodgman, associate director of the SEC’s Enforcement Division, added: “We used high-resolution satellite imagery and other innovative investigative techniques to unearth that tens of thousands of purportedly built-and-sold homes were, in fact, nothing but bare soil.”

The SEC separately issued a trading suspension in the securities of Homex until March 17 owing to “a lack of adequate and accurate information” in the company’s annual reports.

Mexico’s National Bank and Securities Commission imposed a $600,000 fine on Homex in October 2015 for improperly preparing its financial statements.

Homex, based in Culiacán in northwest Mexico, was founded in 1989 and has mainly built affordable housing for low and middle-income groups. In recent years it has struggled with debts of up to $5bn, partly as a result of a shift in government policy over subsidies.

Top image: Some houses that Homex actually did build, near El Lencero Airport in Veracruz (Panoramio)

Further Reading:

Comments

Comments are closed.

Is this another case where the REGULATORS may have been suspected to be in collusion when they negotiated the deal which must be approved by a US court where the company Homex did not admit culpability to accounting fraud involving reported sales of ten of thousands of homes it never even built and thus overstating its revenues by $3.3bn resulting in the company shares selling for more than 1,200 pesos in 2008 but last week they were worth less than one peso valued at in March 2017. The Mexican housebuilder has settled charges.

The SEC negotiated settlement, Homex agreed that for a period of five years it will not participate in the US stock market The company, filed for bankruptcy protection in April 2014 and emerged in October 2015 with new equity ownership. The company’s former chief executive and chief finance officer have been placed on unpaid leave since May 2016 and, according to the SEC, Homex has undertaken “significant remedial efforts” and cooperated with its investigation.

QUESTION ARISES: IS THIS A DETERRENT PENALTY ON THOSE INVOLVED WHO MAY HAVE COME BACK WITH A NEW EQUITY OWNERSHIP AND THERE MAY BE COLLUSION?