Contractors expect increasing demand for numerous types of projects in 2022 despite ongoing supply chain and labour challenges, as most firms plan to add workers this year, according to survey results released this week by the Associated General Contractors of America (AGC) and Sage.

“Contractors are, overall, very optimistic about the outlook for the construction industry in 2022,” said Stephen E. Sandherr, AGC chief executive. “While contractors face challenges this year, most of those will be centered on the need to keep pace with growing demand for construction projects.”

In 15 of 17 categories of projects, most survey respondents expect growth. Retail and office construction were the two exceptions.

Contractors are most optimistic about highway and bridge construction, which has a net reading of positive 57%. They are similarly optimistic about transit, rail and airports projects, with a net reading of 51%, and water and sewer projects, with a net reading of 50%.

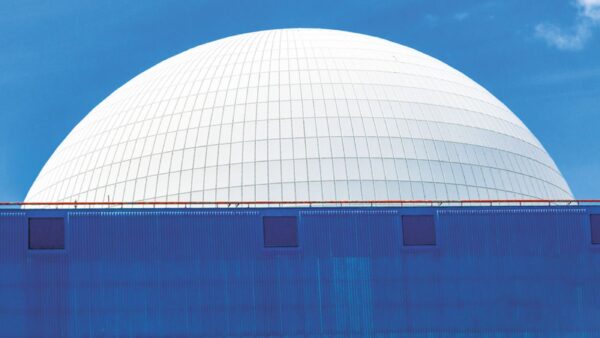

These segments all stand to get increased federal spending because of US President Joe Biden’s Infrastructure Investment and Jobs Act. Contractors are also upbeat about demand for federal construction projects, with a net reading of 37%, and power construction, with a net reading of 29%.

The highest expectations among private-sector categories, with a net reading of 41% each, are for warehouses and other healthcare facilities, which includes clinics, testing facilities and medical labs. The outlook for hospital construction is also strong, with a net reading of 38%.

Seventy-four percent of respondents expect their firms will add staff in 2022, compared to just 9% that who expect a decrease. Most firms, 47%, expect to increase their headcount by 10% or less.

The AGC notes that adding those workers will be a challenge, however, with 83% reporting that they are having trouble filling some or all salaried or hourly craft positions.

The pandemic continues to affect construction; 84% of respondents report higher-than-anticipated costs, while 72% say projects have taken longer because of the pandemic. As a result, 69% have put higher prices into bids or contracts, while 44% have specified longer completion times.

Supply chain bottlenecks continue to irk: only 10% of firms report no significant supply chain problems. Sixty-one percent have turned to alternative suppliers and 48% have specified alternative materials or products.

Forty-six percent of contractors report having a project delayed in 2021 but rescheduled, while 32% had a project postponed or canceled without rescheduling.

The outlook was based on survey results from some 1,000 firms from all 50 states and the District of Columbia.