Pan-African reinsurer Continental Re wants to double premium income from its property and engineering business to $80m over the next five years on the back of what it hopes is an infrastructure boom on the continent.

“We are seeing growth across all our business lines. The opportunity primarily is in … construction projects we are seeing on the continent,” Executive Director Lawrence Nazare told Reuters.

Nigeria’s second-largest insurer opened a branch in South Africa last week with the aim of doubling its reinsurance market share to 10% over the next five years, Nazare said.

Other insurance firms are following suit.

Earlier this month Contintal Re launched a new specialist subsidiary, Continental Property and Engineering Risk Services, to meet growing demand for specialist engineering insurance risk advisory services.

Investment in African mega projects surged 46% to $326bn in 2014, according to the third annual Deloitte African Construction Trends Report.

Nazare said the packages it offered are getting bigger.

“We are in the process of arranging deals that would allow us to provide at least $100 million in each of the deals we are involved in this year,” he said. Last year’s transactions were of about $20 million each.

Continental Re was expanding so fast it would need to raise extra capital within the next 12 months, Nazare said, without giving an indication of how much was needed.

Reuters reported that low insurance penetration is also attracting foreign players such as Anglo-South African Old Mutual, which paid nearly $100 million for a 23.3 percent stake in Kenyan insurer UAP Holdings.

Other South African and European insurers such as Switzerland’s Swiss Re and France’s AXA have made similar ventures.

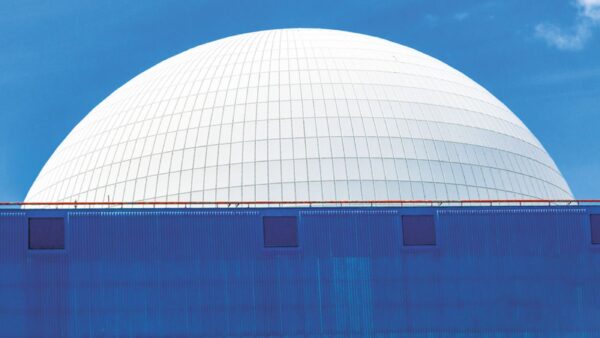

Photograph: Infrastructure upgrade underway at Port of Ngqura, South Africa (Mott MacDonald)