Chinese companies are increasing their presence in the world’s hottest transport infrastructure markets, according to the latest data from Fitch Solutions Macro Research, a unit of Fitch Group.

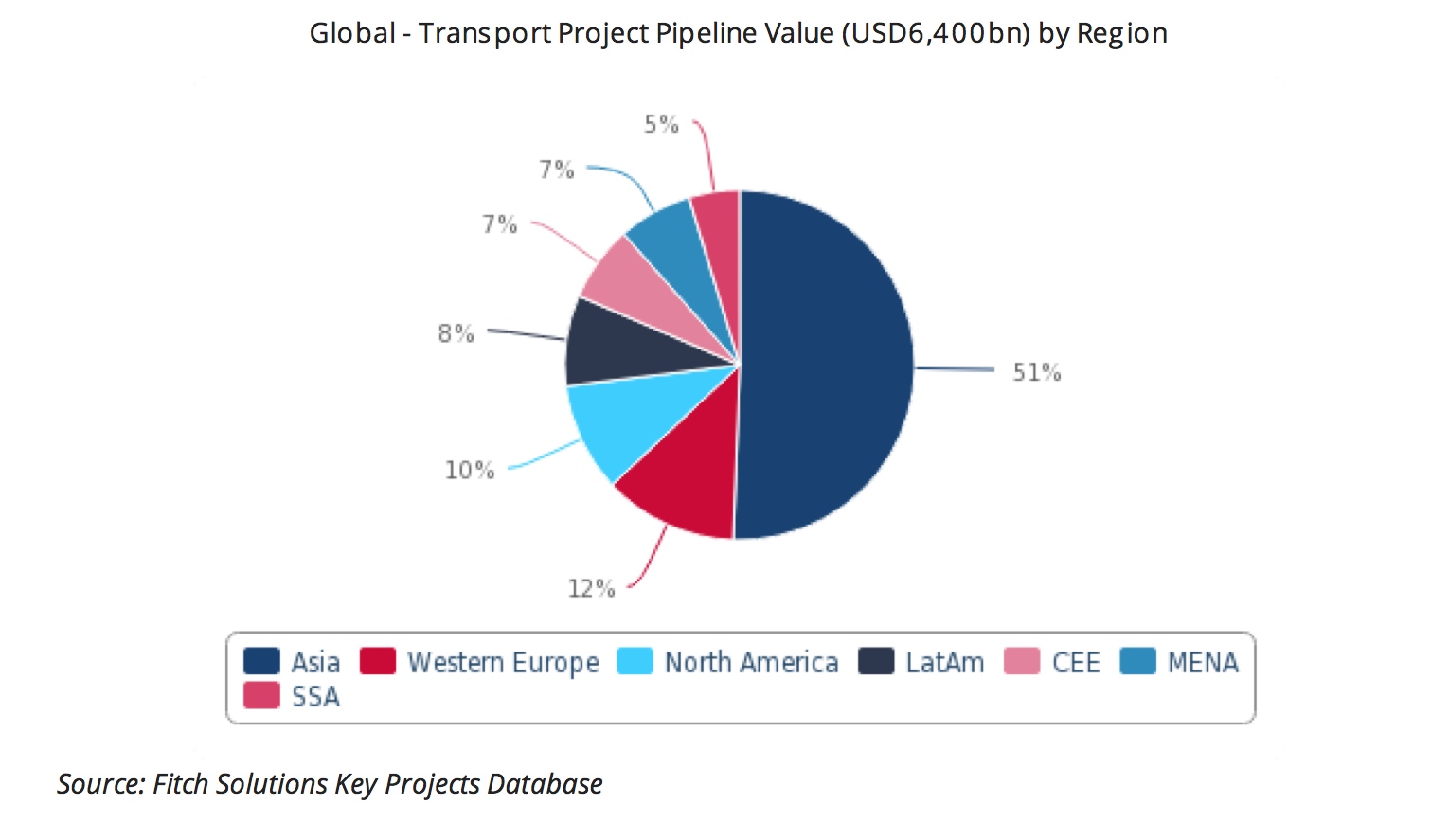

Its catalogue of over 23,000 projects in 196 countries shows Asia’s infrastructure pipeline making up 51% of the global pie in terms of project value.

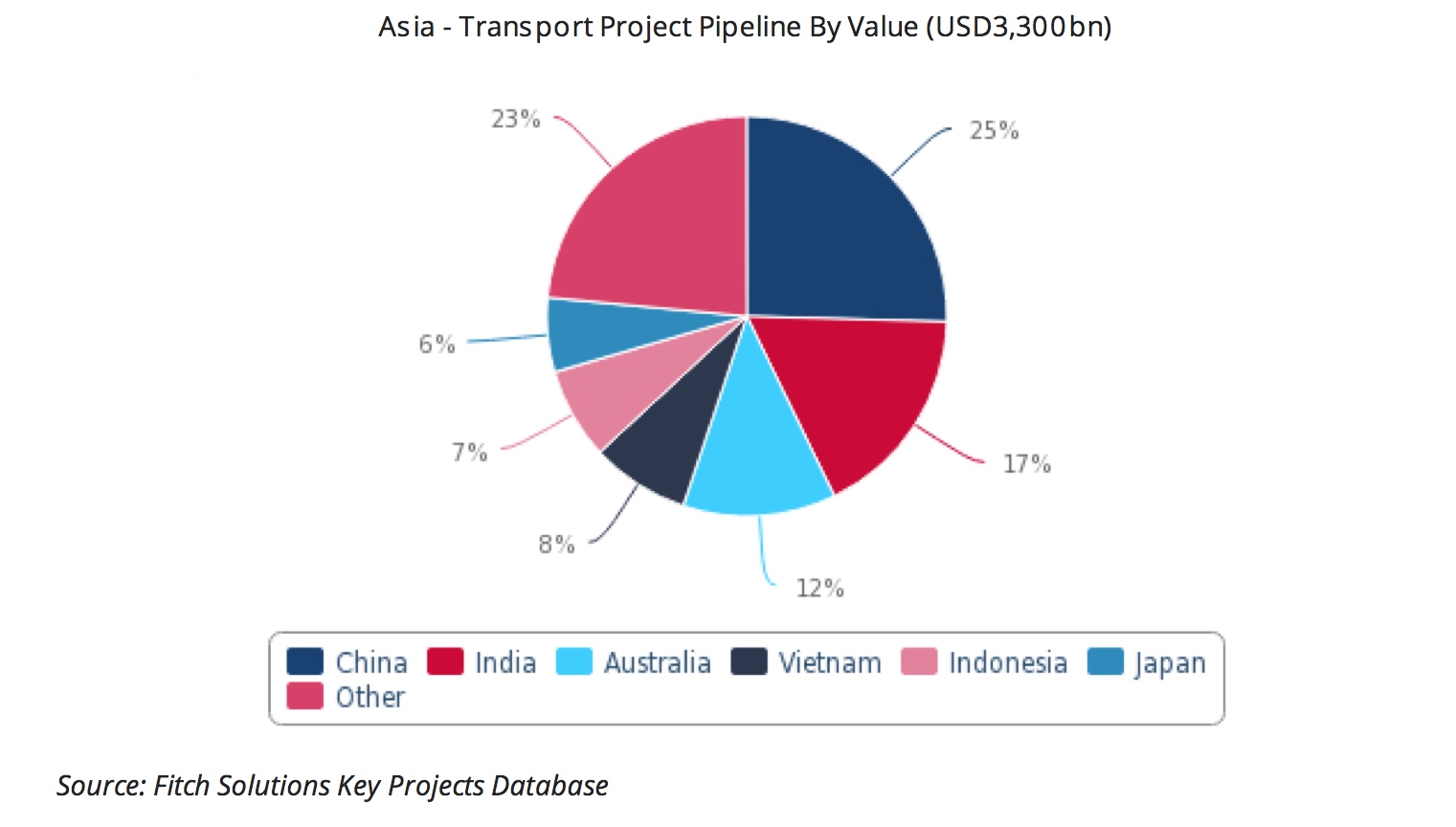

And within Asia, China has the biggest transport project pipeline by value, which is close to $830bn.

In a note to GCR, Fitch predicted that China’s transport sector will grow by 5.5% a year to 2028, outpacing the broader construction sector that it says will grow on average by 4.2% a year in the same period.

So, Chinese companies are busy at home, but they are also busy abroad, often under the banner of its Belt & Road Initiative (BRI).

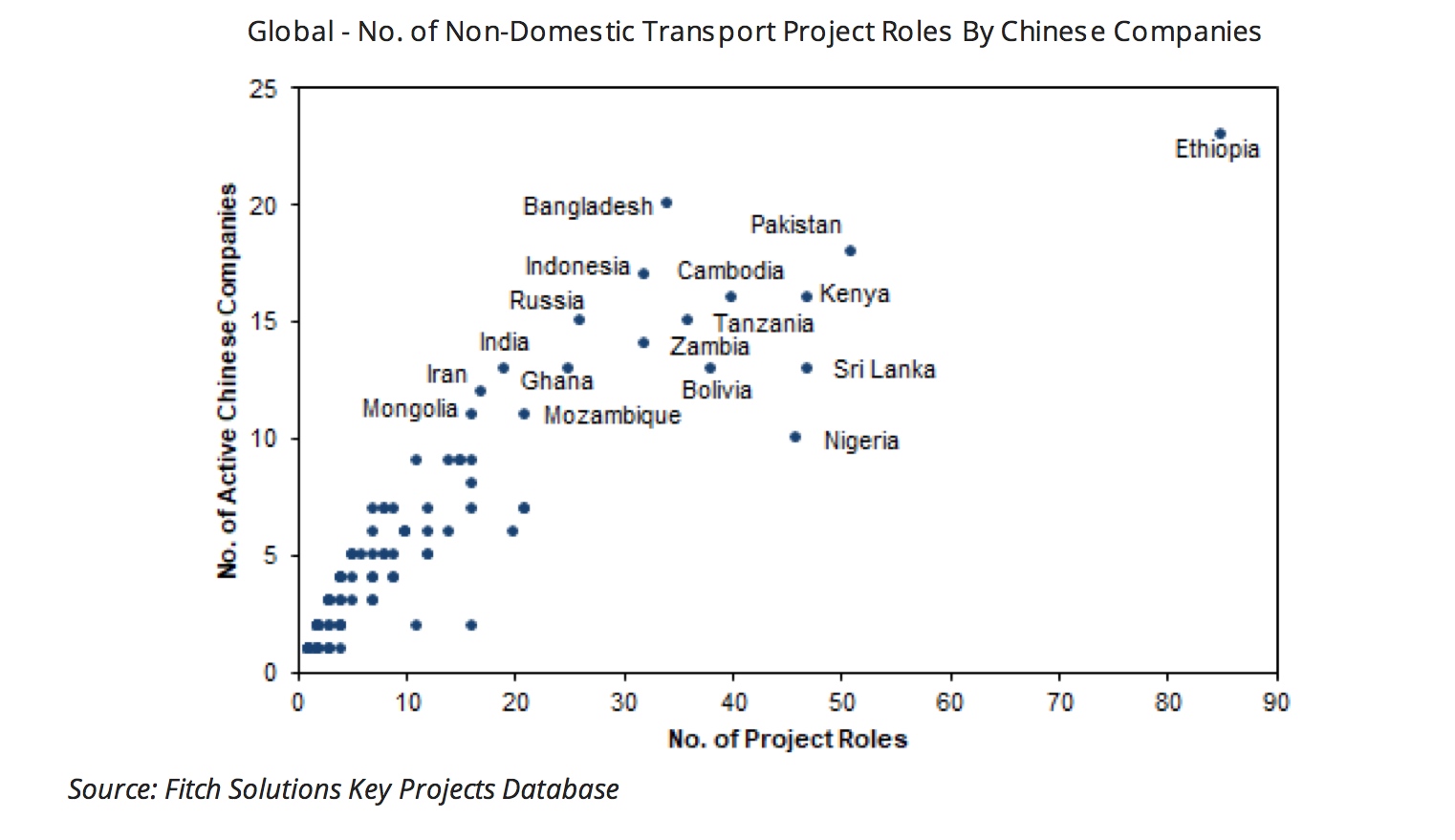

Chinese firms are super-active in Asia and Africa, especially Ethiopia

Chinese companies are active in 123 countries as builders, financiers and sponsors, according to the data.

Nowhere are they more active than in Ethiopia, where close to 25 Chinese companies are working on around 85 projects. Most prolific is the giant China Communications Construction Company.

Bangladesh and Pakistan also host many Chinese companies, around 20 each. A smaller number of Chinese companies are active in Kenya, Sri Lanka and Nigeria, although in each of these countries Chinese firms are engaged in between nine and 15 active projects.

Chinese contractors can credit their impressive global reach to Chinese finance for infrastructure projects, which normally comes with the condition that a Chinese contractor does the work.

Asia dominates the global transport projects pipeline

Consequently, the Exim Bank of China is the most active Chinese entity in infrastructure projects, both in terms of the number of occupied project roles and the geographic spread of these roles.

Sri Lanka hosts Exim Bank’s largest presence in any single country, accounting for 11% of the bank’s project roles, followed by Ethiopia with 7% and Tanzania with 6%.

Meanwhile, Western Europe sits as the second-largest region behind Asia in terms of the size of its infrastructure pipeline: Fitch values it at close to $800bn.

In Asia, China, India and Australia are the biggest single markets

It is followed by North America’s respectable pipeline of $650bn.

Next in the league table is India. Fitch values its pipeline at over $550bn, equivalent in value to all of Latin America, which demonstrates the link between big populations and infrastructure demand.

The bulk of India’s project pipeline is rail, which accounts for over 52% of its pipeline value, followed by roads, at 36%.

Top image: A section of the Sukkur-Multan motorway in Pakistan, built in just three years by China State Construction Engineering Corporation (From the Facebook page of China-Pakistan Economic Corridor)

Comments

Comments are closed.

Saw that coming more than a decade ago and they won’t stop there