New organisation’s 57 founding members hope for loans to boost domestic development.

With just hours to go before the deadline on New Year’s Eve last week, the Philippines became the last country to scramble aboard the Chinese-led Asia Infrastructure Investment Bank (AIIB).

The United States will not have been pleased. When the UK signed up as an AIIB founding member in March last year, an unnamed senior US official complained of "constant accommodation" of China.

Japan remains the only big US ally in the region not taking part in the historic initiative.

Some people say there are only 65 countries involved but that’s a misunderstanding. It’s a new method of development for China and the world– Zhao Changhui, China Export-Import Bank

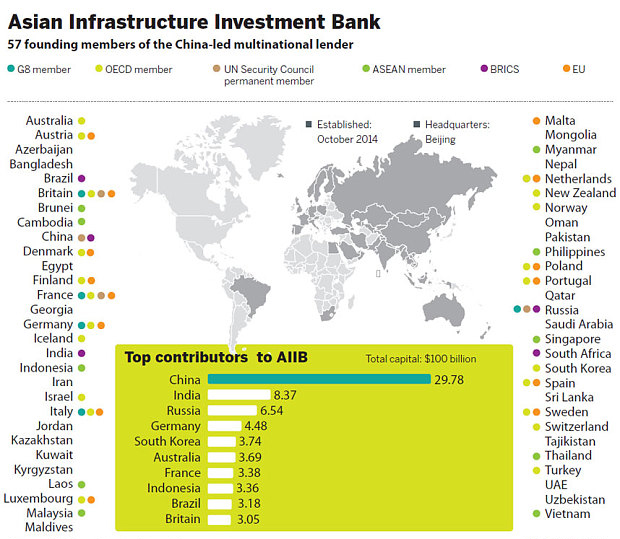

So now the AIIB opens for business. The first meeting of its board of governors will be held on 16 January, and anticipation is growing as to where it will begin investing its $100bn of available capital, and how the bank’s operations will work out in practice.

Jin Liqun, the bank’s president-designate, told China’s Xinhua news agency that the priority would be in energy, transportation, rural infrastructure, environmental protection and logistics. The first loans are expected in the summer.

Although China does not control the bank, it is the largest shareholder, with 30% of its capital. And, as the US does with the World Bank, China holds the power to veto its schemes.

China will want to gear AIIB financing to contribute to its grand strategy of developing industrial and transport corridors between Asia and Europe – its "Belt and Road" plan.

What AIIB members will be wondering is how that will fit with their domestic development agendas, particularly those countries – such as Brazil – that are outside the Belt and Road zones.

Jin Liqun, former chairman of the China International Capital Corporation, and now president of the AIIB (World Economic Forum)

This uncertainty explains why some countries in south-east Asia, such as the Philippines and Vietnam, hesitated before joining.

In the end, however, both found the attraction of leveraging capital for domestic projects too strong to resist, even though their relations with Beijing are severely strained by China’s territorial manoeuvring in the South China Sea.

No country left out

Proponents of the Belt and Road, a vast vision thought directly to involve 65 countries, say that no country is excluded from its beneficial effects.

Zhao Changhui, chief risk analyst at China Export-Import Bank, told The Financial Times in November: "Some people say there are only 65 countries involved but that’s a misunderstanding. It’s a new method of development for China and the world."

Meanwhile, the lure of AIIB funding extends beyond underdeveloped economies in Asia.

Joe Hockey, the former Australian treasurer who introduced the legislation enabling the country to join the AIIB last year, said it would help bridge Asia’s infrastructure financing gap, partly by catalysing private sector investment. A study by the Asia Development Bank found that $8 trillion was needed to keep the continent’s economy on track.

But the real attraction for Australia – the sixth largest AIIB shareholder with a contribution of $3.7bn – is gaining access to funds to develop its mining infrastructure. Hockey stressed the construction of rail lines and ports to boost iron ore exports.

Who’s in, and by how much (AIIB)

The attraction of China’s investment largesse, whether through the AIIB or not, is clear when you consider that another country that hopes to benefit is located on the other side the world.

UK chancellor George Osborne is hoping that Chinese finance will help develop UK infrastructure, particularly in the north of the country, where Chinese private investment has already been flowing at scale.

What we do know so far is that Jin Liqun wants the bank to back schemes that are "clean and green", as the FT put it last year, although it is not clear if the bank will fund coal-fired or nuclear plants.

Jin also wants the bank to be lean. He said that the AIIB, by keeping its bureaucracy to a minimum, would be able to act more quickly than the World Bank and other multilateral lenders.

Top image: An overloaded train arrives in Jakarta, Indonesia during rush hour in 2012. The state-run rail operator decided that year to hang concrete balls above tracks to deter "train surfers". Indonesia is one of the AIIB’s founding members (ROMEO GACAD/AFP/Getty Images)

Comments

Comments are closed.

Don’t forget, china is the only member with a Veto-right !